The Five-Year Rule for Home Price Perspective

.avif)

Headlines are saying home prices are starting to dip in some markets. And if you’re beginning to second guess your plans based on what you’re hearing in the media, here’s what you need to know.

It's true that a few metros are seeing slight price drops. But don't let that overshadow this simple truth. Home values almost always go up over time (see graph below):

While everyone remembers what happened around the housing crash of 2008, that was the exception – not the rule. It hadn’t happened before, and hasn’t since. There were many market dynamics that were drastically different back then, too. From relaxed lending standards to a lack of homeowner equity, and even a large oversupply of homes, it was very different from where the national housing market is today. So, every headline about prices slowing down, normalizing, or even dipping doesn’t need to trigger fear that another big crash is coming.

Here’s something that explains why short-term dips usually aren’t a long-term deal-breaker.

What’s the Five-Year Rule?

In real estate, you might hear talk about the five-year rule. The idea is that if you plan to own your home for at least five years, short-term dips in prices usually don’t hurt you much. That’s because home values almost always go up in the long run. Even if prices drop a bit for a year or two, they tend to bounce back (and then some) over time.

Take it from Lance Lambert, Co-Founder of ResiClub:

“. . . there’s the ‘five-year rule of thumb’ in real estate—which suggests that most buyers can buffer themselves from mild short-term declines if they plan to own a property for at least that amount of time.”

What’s Happening in Today’s Market?

Here’s something else to put your mind at ease. Right now, most housing markets are still seeing home prices rise – just not as fast as they were a few years ago.

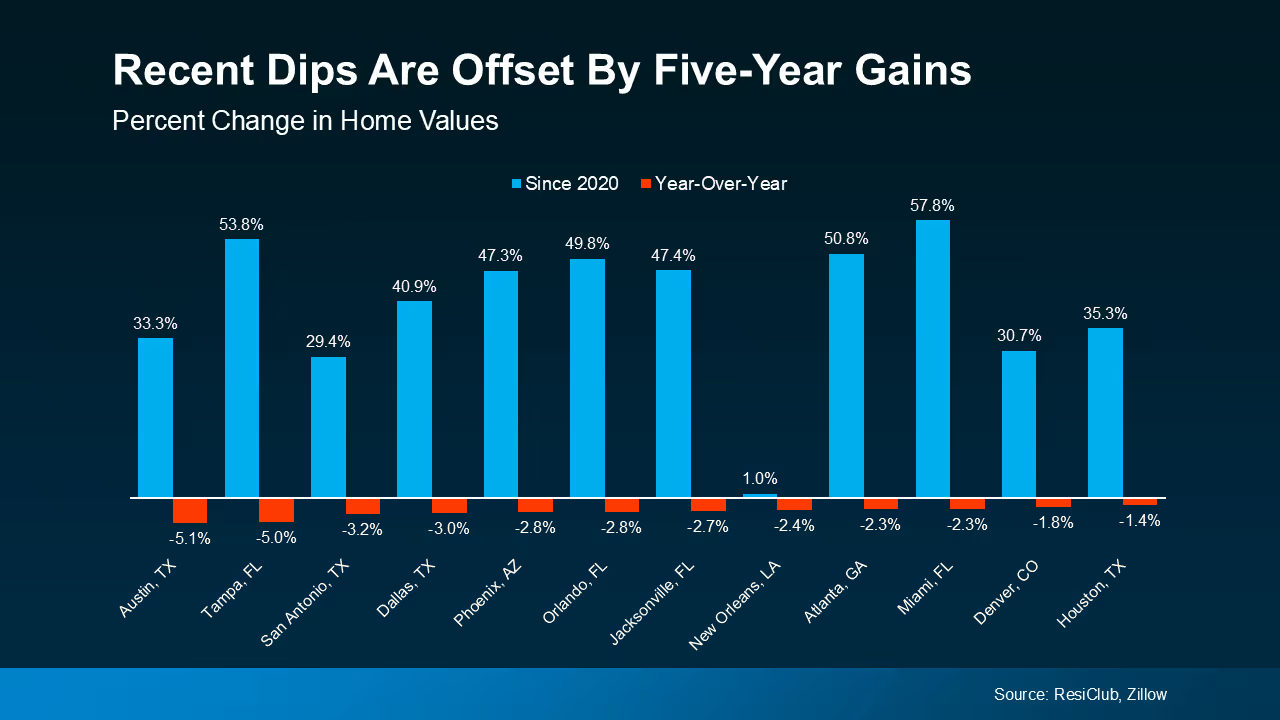

But in the major metros where prices are starting to cool off a little (the red bars in the graph below), the average drop is only about -2.9% since April 2024. That’s not a major decline like we saw back in 2008.

And when you look at the graph below, it’s clear that prices in most of those markets are up significantly compared to where they were five years ago (the blue bars). So, those homeowners are still ahead if they’ve been in their house for a few years or more (see graph below):

The Big Picture

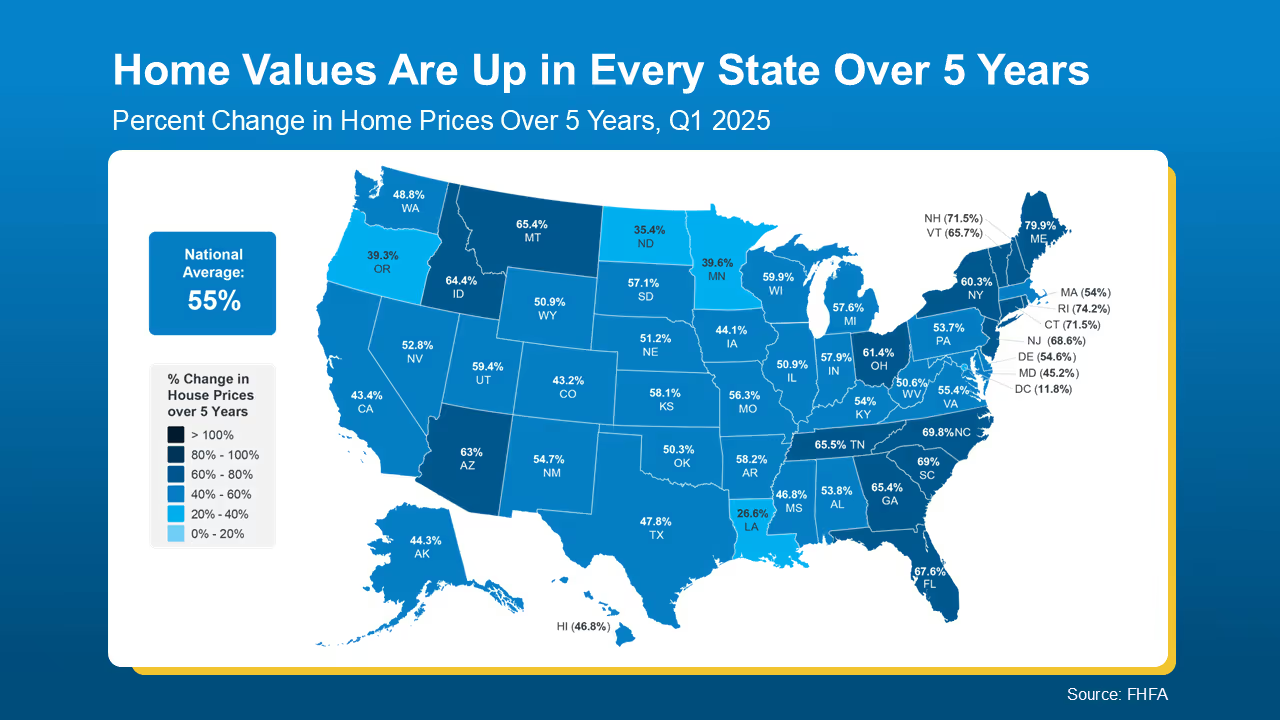

Over the past 5 years, home prices have risen a staggering 55%, according to the Federal Housing Finance Agency (FHFA). So, a small short-term dip isn’t a significant loss. Even if your city is one where they’re down 2% or so, you’re still up far more than that.

And if you break those 5-year gains down even further, using data from the FHFA, you’ll see home values are up in every single state over the last five years (see map below):

That’s why it’s important not to stress too much about what’s happening this month, or even this year. If you’re in it for the long haul (and most homeowners are) your home is likely to grow in value over time.

Bottom Line

Yes, prices can shift in the short term. But history shows that home values almost always go up – especially if you live there for at least five years. So, whether you’re thinking of buying or selling, remember the five-year rule, and take comfort in the long view.

Discover more articles.

Stay informed with more of our informative blog posts.

.png)

.png)