Huge Rate Bounce After Stunningly Strong Jobs Report

.avif)

There was a lot riding on Friday's big jobs report with a weak result likely to reinvigorate a move to long-term lows and a strong result likely to push rates higher. It ended up being VERY strong, thus pushing rates higher VERY quickly.

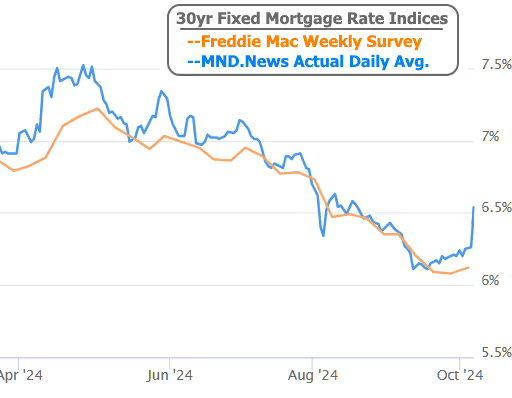

The following chart shows the day over day change in the 30yr fixed rate index from Mortgage News Daily:

The worst day in April was just a bit more abrupt, but it's fairly uncommon to see a jump of more than 0.2%. In outright terms, things look a bit better considering the ground covered since April.

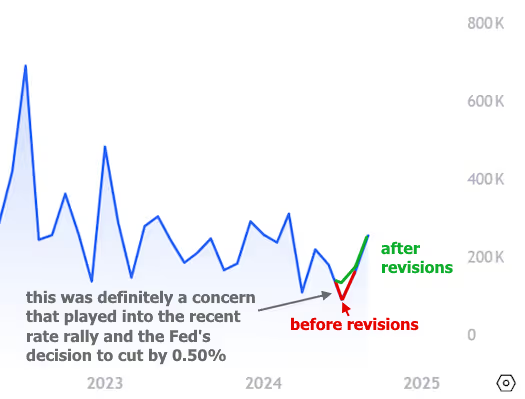

The most important headline in the jobs report is nonfarm payrolls (NFP), which is a count of new jobs created in the most recent month (September, in this case). Not only did September's 254k payrolls crush forecasts calling for 140k, but the past 2 months were revised higher as well. This is important because recent payroll data factored into the Fed's decision to cut rates by 0.50% two weeks ago. Whereas the trend looked to be trailing off at weaker and weaker levels, it now looks a bit more resilient (mainly because the low point from 2 months ago is now higher than the low point from earlier in the year).

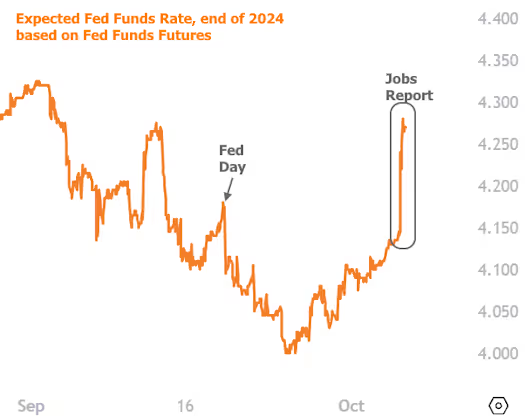

If the Fed had seen that "higher low" in NFP and if they'd known about today's 254k payroll count two weeks ago, would they have been as willing to cut rates by 0.50%? The market doesn't think so, and it quickly moved to adjust its expectations for where the Fed Funds Rate will end up this year.

Given all the upward momentum in rates seen over the past few weeks, as well as today's exclamation point, some market watchers are hoping that next week's inflation data can help put a ceiling over the current range. While we wouldn't rule out an impact from Thursday's Consumer Price Index, it's important to remember two things.

First, the market has largely moved on from obsessing over inflation in favor of obsessing over the labor market. We've seen smaller and smaller reactions to inflation-related data and it's basically being monitored only for signs of a bounce.

Second, inflation data can still hurt rates if it manages to show signs of a bounce. In that sense, it's an asymmetric risk where higher inflation would hurt rates more than lower inflation would help.

In addition to the data, next week brings a deluge of speeches from Fed officials to help the market make sense of how the jobs report may or may not change the calculus. If the past is any precedent, the Fed tends to remind markets not to get too wrapped up in a single economic report, but the counterpoint is that this particular single report brought fairly big revisions to the last few reports as well.

Longer term, the path of rates will depend on the economy. Job data may be the most important, but the sum of other reports can create momentum in either direction. As we've advised in the weeks leading up to and away from the Fed's rate cut, there are several past examples of mortgage rates moving higher for a time after a Fed rate cut! There's no way to know if this will continue to be one of those examples--only that is has been for the past few weeks.

Discover more articles.

Stay informed with more of our informative blog posts.

.png)

.png)